Welcome to PyreSwap! - The Short Version

The following provides a brief overview of the tokenomics involved in PyreSwap, as well as PyreSwap's tokenomic associations with the Greater PyreSwap Ecosystem.

For a more comprehensive exposition on tokenomics, please read The Long Version.

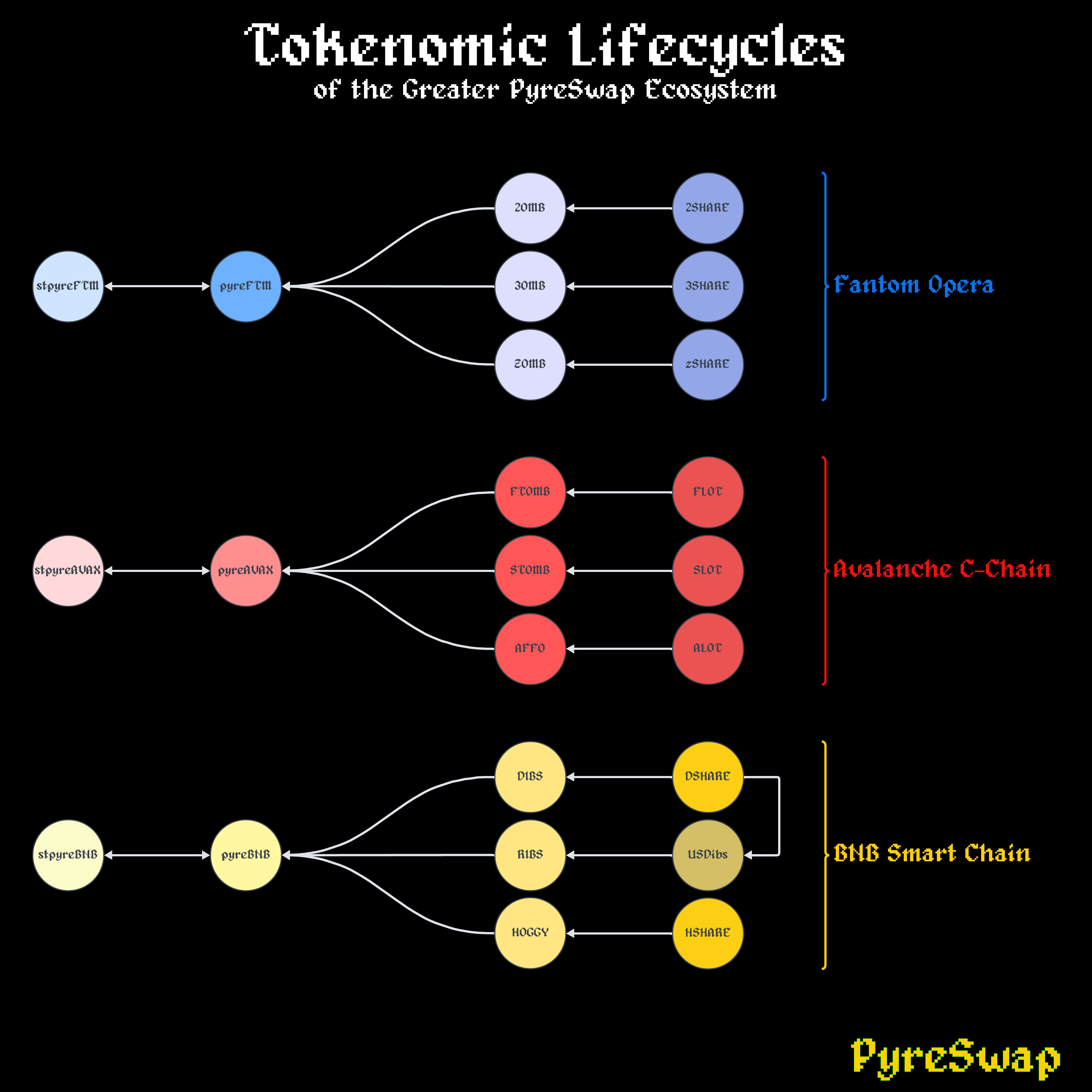

Tokens of PyreSwap and the Greater PyreSwap Ecosystem

The first of its kind, the Greater PyreSwap Ecosystem (GPSE) is the most comprehensive endogenous money system in DeFi, and has the highest amount of complementary currencies in all of web3.

While an entire treatise on those two subjects would be a better fit for The Long Version, we shall attempt to simplify those ideas into the following summary:

The GPSE as a whole is comprised of a number of different tokenomic systems and associations.

However, the dominant configuration of tokenomics as it applies to PyreSwap, involves elastic supply tokenomics.

Additionally, the elasticity of supply is not derived from static mechanisms of supply expansion and contraction, but rather dynamic ones that are responsive to (both bullish and bearish) market conditions.

Meaning, the expansion and contraction of (pyreAVAX, pyreBNB, pyreFTM, etc.) token supply is not controlled by any centralized entity with a discretionary policy, but rather through the aggregated activities of variegated market actors (the userbase), as they interact with each other, measured against objective system standards and criteria.

The expansions and contractions happen as an indirect byproduct of actions taken from the ecosystem's userbase, as they make decisions in accordance with their own stylized and assumedly self-serving motives.

The tokens of the GPSE affect each other, and even provide for each other levels of support and resistance.

To truly understand a token in the GPSE is to understand how it affects its tokenomic associations, as well as how it is affected by them.

Tokens of the Greater PyreSwap Ecosystem

If we interpret the meaning of "currency" to include cryptocurrency, then the GPSE is the most sophisticated orchestration of complementary currencies in web3, and possibly world history.

The tokens in the GPSE include (in no particular order):

| Fantom | Avalanche | BSC |

|---|---|---|

| 2SHARE | FLOT | DSHARE |

| 3SHARE | SLOT | USDibs |

| zSHARE | ALOT | HSHARE |

| 2OMB | FTOMB | DIBS |

| 3OMB | STOMB | RIBS |

| ZOMB | AFFO | HOGGY |

| 2BOND | FBOND | DBOND |

| 3BOND | SBOND | USDBOND |

| zBOND | bAFFO | bRIBS |

| pyreFTM | pyreAVAX | bHOGGY |

| stpyreFTM | stpyreAVAX | pyreBNB |

| stpyreBNB |

At the time of this writing: Not all of these tokens currently exist. Please be aware of the existence of scam and impostor GPSE tokens.

Additional tokens may be added in later phases of PyreSwap's roadmap.

The tokenomics of PyreSwap's native instruments will be the focus of this documentation.

For more information on the GPSE tokens not explained here, please see the documentation of their respective projects.

Tokens of PyreSwap

During Phase I, there are six main tokens native to PyreSwap:

- pyreAVAX

-

stpyreAVAX

-

pyreBNB

-

stpyreBNB

-

pyreFTM

- stpyreFTM

Fundamentally, this list of six is an extrapolation of just two tokens, configured as a pair, triplicated on three different blockchains.

You may see these tokens referred to as "pyreGAS" and "stpyreGAS" for hypernym simplifications, both in this documentation and elsewhere.

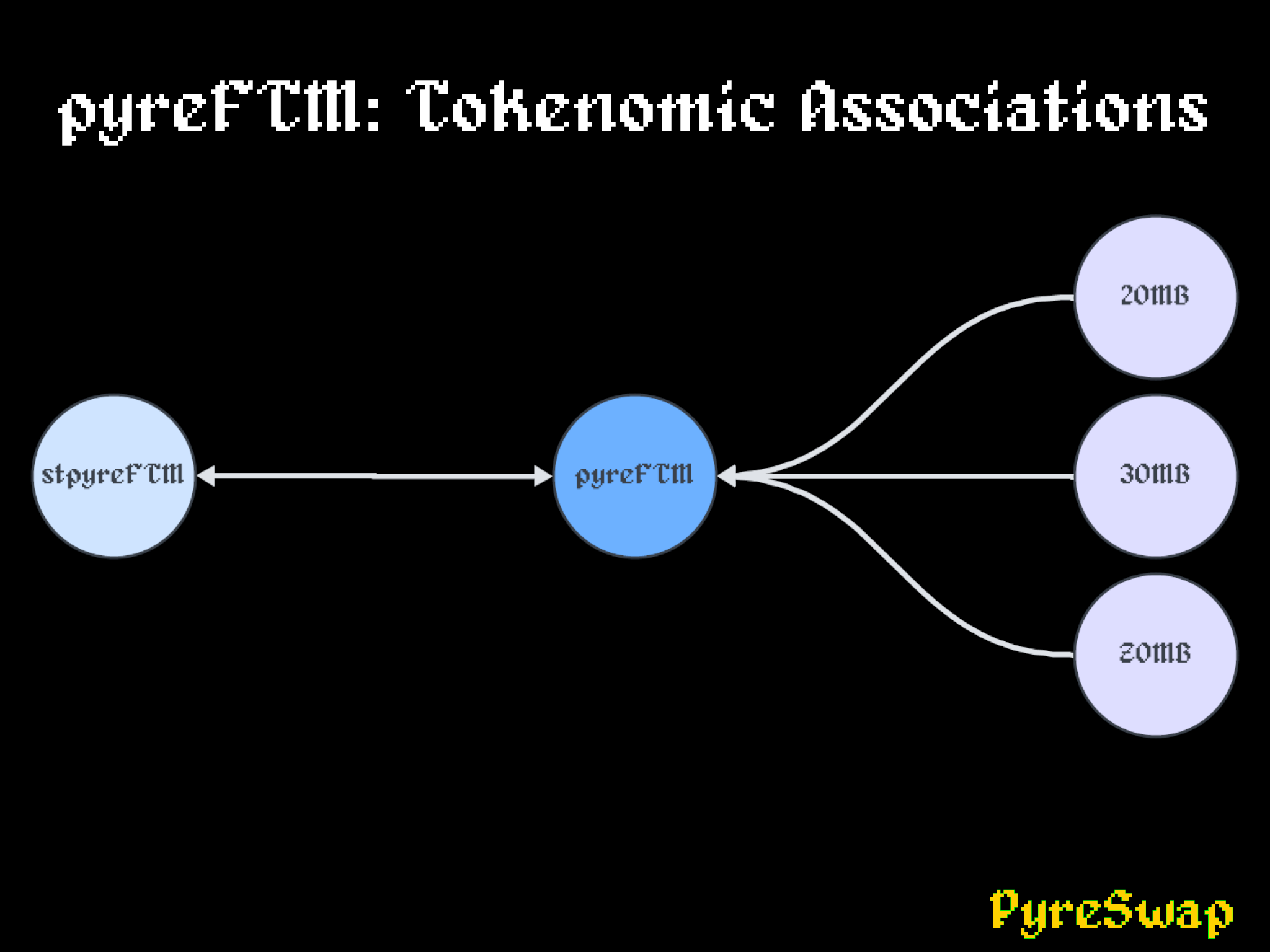

For the sake of aiding comprehension, we will use pyreFTM and stpyreFTM as our examples below.

pyreGAS

pyreGAS is a hypernym that refers to pyreAVAX, pyreBNB, pyreFTM, etc.

(In contrast, pyreAVAX, pyreBNB, and pyreFTM can serve as hyponyms of pyreGAS.)

At the time of this writing, pyreFTM's tokenomics are the most completely configured, and thus pyreFTM will serve as the best example for pyreGAS.

pyreFTM is an elastic supply token, which means its supply expands and contracts.

The general mechanisms by which its supply expands and contracts are referred to as methods.

The specific mechanisms by which its supply expands and contracts are referred to as vectors.

The conceptual means by which its supply increases are categorically referred to as the "methods of expansion," and the conceptual means by which its supply decreases are categorically referred to as "methods of contraction."

The concrete means, which compose these methods, are referred to as "vectors of expansion" and "vectors of contraction."

(Based on its design, an elastic supply token may have multiple methods of both expansion and contraction, as well as multiple vectors derived from the methods.)

pyreGAS Expansion

At the time of this writing, aside from small initial token amounts of pyreFTM minted during beta testing and genesis, pyreFTM has a main method for its supply expansion, which is known as meeding. Additionally, there is an auxiliary method, which is really an "expansion-as-a-technicality" that occurs due to unstaking.

For more information on "Meed," please read Products.

Expansion - Meeding

Within the meeding method of its supply expansion, pyreFTM has three vectors of expansion:

- Meeding 2OMB for pyreFTM (1:1)

- Meeding 3OMB for pyreFTM (10:1)

- Meeding ZOMB for pyreFTM (100:1)

As 2OMB, 3OMB, or ZOMB are used to meed for pyreFTM, they are burned, and the corresponding amount of pyreFTM is minted to the meeding user.

Meeding increases pyreFTM's total supply, while decreasing the total supplies of 2OMB/3OMB/ZOMB.

Expansion - Unstaking

In addition to meeding, pyreFTM has another auxiliary method for its supply expansion, which is when it is unstaked from the Incantation WitchVault. This method contains a single vector, and at the time of this writing is referred to with the same name, an autohyponym.

During unstaking, stpyreFTM is burned and pyreFTM is minted back to the unstaking user.

In this context, meeding is referred to as the "main" method and unstaking as the "auxiliary" method, due to the fact that while unstaking does mint new pyreFTM, it can realistically only ever "mint back" a smaller amount than the pyreFTM that was effectively burned, to mint the stpyreFTM. (The reason this amount of pyreFTM is assumed smaller when it is "minted back" through unstaking is due to the probability of smoldering.)

Therefore, the meeding rate is the dominating factor, and thus the "main" method, in the net expansion of pyreFTM's total supply, over time.

pyreGAS Contraction

At the time of this writing, pyreFTM has two methods for its supply contraction:

- Diminution/Decay

- Staking in the Incantation WitchVault

Contraction - Diminution

By "diminution" we mean that the entire token supply of pyreFTM, in all locations, reduces its quantity by a fixed percentage.

This "decay" makes pyreFTM's market price slightly increase, due to it becoming more scarce in liquidity pools.

Diminution (as a method) has three vectors of contraction:

- At 0.3999 TWAP and under, pyreFTM decays ubiquitously at 1.6% per epoch.

- At 0.5999 TWAP and under, pyreFTM decays ubiquitously at 0.4% per epoch.

- At 0.7999 TWAP and under, pyreFTM decays ubiquitously at 0.2% per epoch.

At 0.8000 TWAP and above, pyreFTM does not diminutize.

Diminution occurs as a "single stroke," in synchrony with the transpiration of PyreSwap's epoch system. Meaning, pyreFTM is not actively decaying all the time, but only at the exact moment of the epoch's transpiration. After which, it is again "inert" for the six-hour duration of the epoch; the next approximate 5 hours, 59 minutes, and 59 seconds.

Based on the results of beta testing, the decay rates may be modified at a later date, or eliminated altogether.

Contraction - Staking

When pyreFTM is staked into the Incantation WitchVault (IWV) by a user, that pyreFTM is burned, and stpyreFTM is minted, which is held by the user as a receipt token.

A user's "staked balance" of pyreFTM is technically a representation of their wallet's current stpyreFTM balance.

Therefore, staking pyreFTM in the IWV is a method of contraction for pyreFTM, but a method of expansion for stpyreFTM.

The method and the vector here may be referred to as the same.

stpyreGAS

stpyreGAS is a hypernym that refers to stpyreAVAX, stpyreBNB, stpyreFTM, etc.

(In contrast, stpyreAVAX, stpyreBNB, and stpyreFTM can serve as hyponyms of stpyreGAS.)

At the time of this writing, stpyreFTM's tokenomics are the most completely configured, and thus stpyreFTM will serve as the best example for stpyreGAS.

stpyreFTM is an elastic supply token, which means its supply expands and contracts.

stpyreGAS Expansion

stpyreFTM has a single method for its supply expansion, which is from pyreFTM being staked in the Incantation WitchVault.

For more information on "Stake," please read Products.

Expansion - Staking

When pyreFTM is staked into the Incantation WitchVault (IWV) by a user, that pyreFTM is burned, and stpyreFTM is minted, which is held by the user as a receipt token.

A user's "staked balance" of pyreFTM is technically a representation of their wallet's current stpyreFTM balance.

Therefore, staking pyreFTM in the IWV is a method of contraction for pyreFTM, but a method of expansion for stpyreFTM.

The method and the vector here may be referred to as the same.

stpyreGAS Contraction

At the time of this writing, stpyreFTM has three methods for its supply contraction:

- Diminution/Decay

- Unstaking from the Incantation WitchVault

- Smoldering from other Incantation WitchVault stakers

Contraction - Diminution

By "diminution" we mean that the entire token supply of stpyreFTM, in all locations, reduces its quantity by a fixed percentage.

This "decay" should make stpyreFTM's market price slightly increase, due to it becoming more scarce in liquidity pools. However, at the time of this writing, stpyreFTM is not deployed in any liquidity pools, at least not by operational intent.

In the future, stpyreFTM will be in liquidity pools.

Diminution (as a method) has three vectors of contraction:

- At 0.3999 TWAP and under, stpyreFTM decays ubiquitously at 1.6% per epoch.

- At 0.5999 TWAP and under, stpyreFTM decays ubiquitously at 0.4% per epoch.

- At 0.7999 TWAP and under, stpyreFTM decays ubiquitously at 0.2% per epoch.

At 0.8000 TWAP and above, stpyreFTM does not diminutize.

Diminution occurs as a "single stroke," in synchrony with the transpiration of PyreSwap's epoch system. Meaning, stpyreFTM is not actively decaying all the time, but only at the exact moment of the epoch's transpiration. After which, it is again "inert" for the six-hour duration of the epoch; the next approximate 5 hours, 59 minutes, and 59 seconds.

Based on the results of beta testing, the decay rates may be modified at a later date, or eliminated altogether.

Contraction - Unstaking

During unstaking, stpyreFTM is burned and pyreFTM is minted back to the unstaking user.

Contraction - Smoldering

In the context of stpyreFTM, smoldering is in fact a 0.1% contraction of a user’s stpyreFTM quantity, that is triggered by other users staking in to the Incantation WitchVault after them.

This burns the held stpyreFTM in tiny amounts, incrementally and ubiquitously.

For more information on "Smoldering," please read Concepts.

Counterintuitively, in the current deployment configuration, each pyreFTM staking transaction receives stpyreFTM as a receipt token, which then becomes the "container" that actually experiences the smoldering contractions, as opposed to the smoldering taking place "inside" the IWV itself.