Welcome to PyreSwap! - The Short Version

There are significantly more concepts involved in PyreSwap's design than those listed here.

For a more comprehensive exposition of the concepts, please read The Long Version.

Vibratility versus Algostability

Since the advent of web3, the volatile price action of many cryptocurrencies has been a driving force in their promotion, and in the generation of their reputation.

To contrast with the dramatic behavior of these instruments, the "stable-coin" as a concept was invented, and multiple stable-coin projects established, applying a variety of collateralization-as-stabilization mechanisms, using both centralized and decentralized frameworks in their implementation.

In an attempt to improve the capital efficiency of these collateralized stable-coins (or perhaps their level of decentralization), the concept of an algorithmic stable-coin, or an "algostable-coin" was also subsequently invented.

There is an overarching sentiment that the execution of algostability projects has been disappointing, usually due to their frequent failure and collapse.

This project, PyreSwap, is intended to contrast sharply with its ideological predecessors, and to pioneer into new territory, by broadening the conceptual spectrum of price action classification, and serve as a vessel to take the evolution of tokenomics to the next level!

The design of PyreSwap (and the GPSE) is based on the invention and integration of a new tokenomic concept, known as "vibratility."

Various tokens inside the GPSE are designed to behave in a "vibratile" manner; a divergence from the volatile or stable expressions of the past.

Vibratile is a lesser known synonym for "pulsatile" or "oscillatory," and is usually applicable to microbiology.

It was chosen for the name of this concept (over "pulsatile" and "oscillatory") in order to be as explicitly clear as possible about what type of expected price behavior was being implemented, due to the words "pulsatile" and "oscillatory" occuring elsewhere in web3 to describe more ambiguous and unrelated things.

Definitions of Vibratile:

The simplest way to think of a vibratile token, is to think of a stable-coin, that doesn't rigidly adhere to its peg, but rather intermittently overshoots its peg, then corrects itself, as well as undershooting its peg, and then correcting itself.

Instead of viewing the token's price drifting away from its peg as a problem, the "vibratile range" can be seen as an opportunity zone.

A vibratile token is not stable, nor can it be considered truly volatile, rather, it is something in between.

The vibratile token does not "reach" its peg, the vibratile token orbits its peg.

Vibratile tokens have no collateral requirement.

For more information on the vibratile behavior of certain GPSE tokens, please read Tokenomics.

For more a more comprehensive explanation on the concept of vibratility, please read The Long Version.

Active Staking versus Passive Staking

PyreSwap's advent brings with it several new concepts in DeFi! Exhilarating, isn't it?

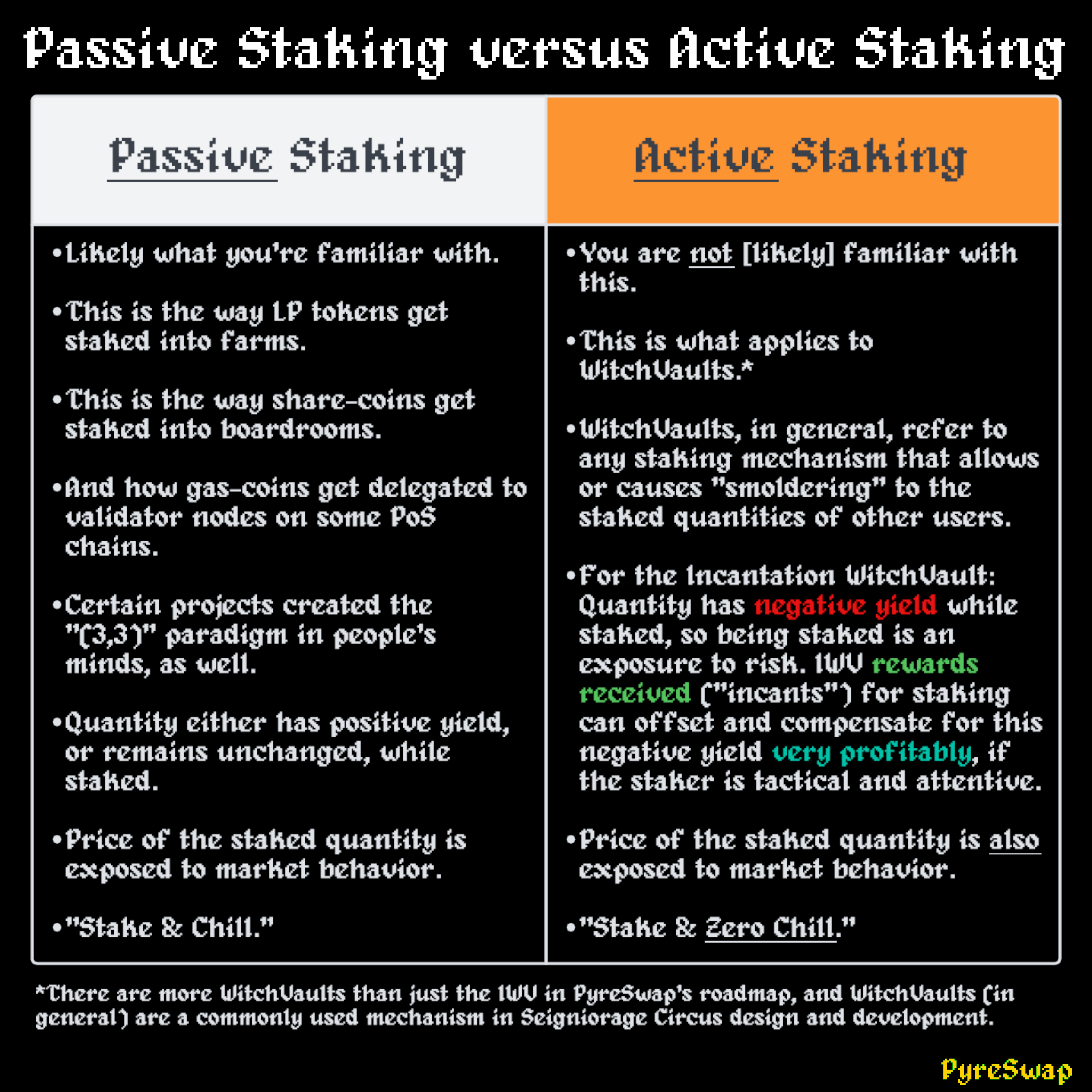

This next concept should aptly be called “Active Staking,” and it contrasts with “Passive Staking.”

Passive Staking is the current status quo for staking, found prevalently across web3.

In a single sentence: “Active Staking” is high-adrenaline staking!

For more information on "Stake," please read Products.

For more information on staking in the Incantation WitchVault, please read Strategy.

Negative Yield versus Positive Yield

If you are unfamiliar with Yield as a concept, please review PyreSwap's NFB policy.

Consider a scenario where you manage a portfolio holding $100, with an intent to invest it.

If you were to realize a 100% gain from investing, this portfolio would now hold $200.

What if you invested again, but realized a 50% loss? This portfolio would now be back to the original $100 balance.

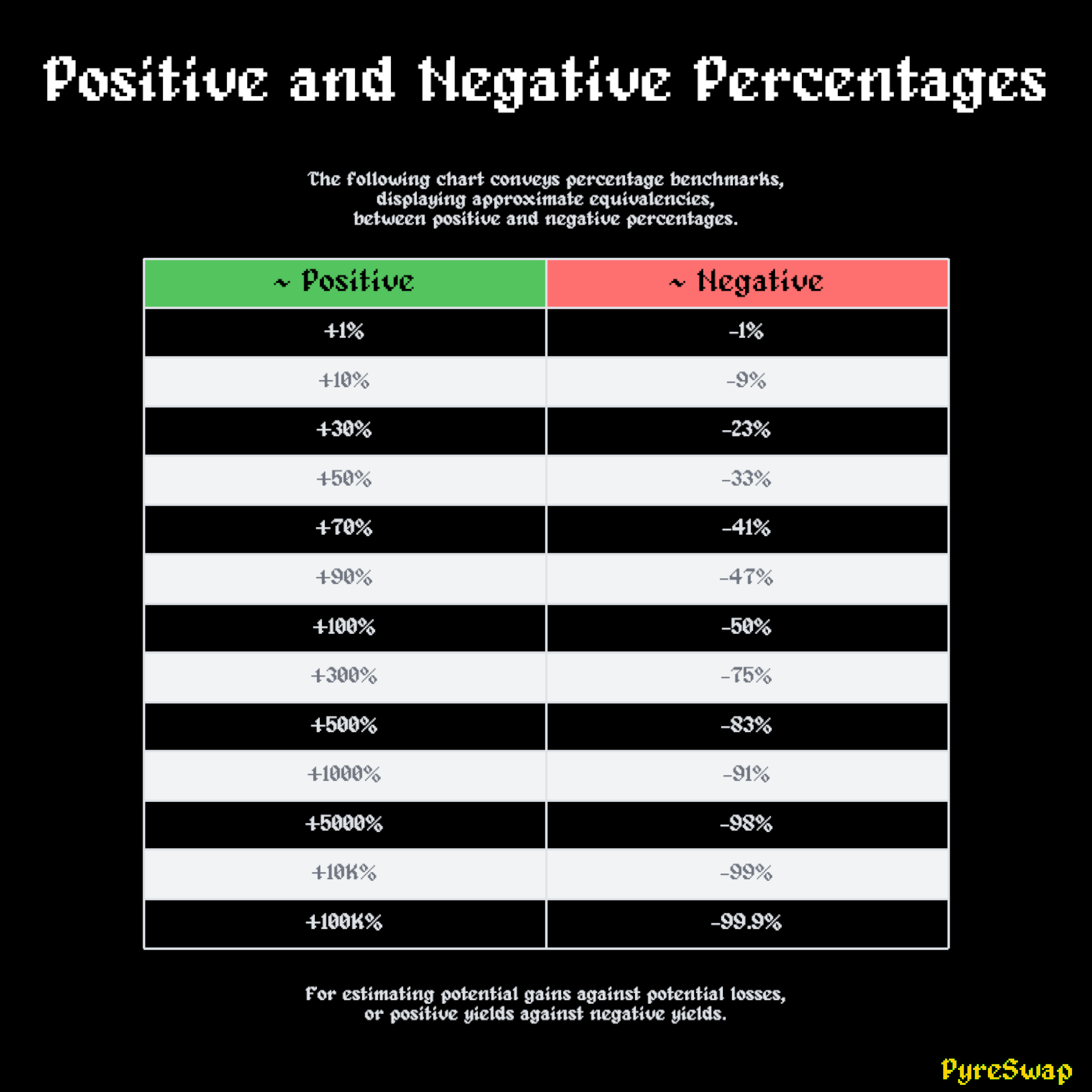

While the integer amount of money was the same both times, the percentages were different, due to the point of reference.

Conventionally, gains are interpreted as positive percentages, and losses as negative percentages.

However, due to the non-fungibility of positive and negative percentages, it is important to remember that their correlation skews, as the percentage values grow larger, in both positive and negative directions.

This is often overlooked and misinterpreted about percentages!

The concept of "yield" is generally displayed as a percentage (in some cases a ratio), and to better understand positive and negative yield, you must comprehend positive and negative percentages.

For more information on the difference between positive and negative percentages, and the significance of this concept, please read Strategy.

Knights versus Witches

There is an ongoing narrative within DLT and DeFi, pertaining to the “value and power of community.”

The Seigniorage Circus wholeheartedly agrees: Community is definitely immensely powerful and valuable!

However!

There is a problem with the notion of community, and that pertains to the [lack of] literacy surrounding the actual mechanisms that uphold community's cohesion. Because the mechanisms that uphold community cohesion, are in fact, economic mechanisms.

Addtionally, it is largely due to the ubiquitous misunderstanding of economic mechanisms in DLT and DeFi projects, that cause so many communities (and projects) to collapse and deteriorate, even with the best intentions.

Maybe you've seen this before?

(Oh, and by “economic mechanisms” we do not necessarily mean the code written in smart contracts.)

For a more comprehensive exposition on community value, cohesion, and conflict, please read The Long Version.

When human nature is taken into consideration, the problem can be summarized as follows:

Communities tend to rally as a unit, against (those perceived to be) bad actors or sources of antagonism, and if the community is not designed from inception to have a clear idea of who their potential threats are, this "lurking opponent" will still exist in the back of the collective mind, but as a vague idea, instead of a clear one.

This “vague idea of an opponent" held in the mind of the community members, regularly manifests and reveals itself in the following scenario:

If there are only two "actor roles" in the commmunity's environment, e.g. investors and developers, this pseudo-cohesion will fracture over time into a struggle between the two groups, perpetually and virtually inevitably, if there is not clear alignment of incentives and responsibilities communicated.

This deterioration is amplified from the ignorance of the competitive dynamic involved in speculative markets, as well as (arguably) the human condition, in general.

If you are unfamiliar with the above symptoms as descriptors of DLT community problems, please review PyreSwap's NFB policy.

Whether the userbase is aware of this or not, web3 communities, and the (assumedly human) actors and actor-groups that comprise them, are piloted, both in activity and in attitude, by the utilities and use cases of the tokens and other instruments they take exposure to. (Also by the economy/ecosystem/environment they are participating in.)

Meaning, if the only point of a token is to buy it and then sell it, and the only point of the community is the token, the community has nothing to actually do with each other, other than to use each other for exit liquidity.

There is no real community! It is a pseudo-community.

And a group that cannot work together to solve their shared problems, will not stay in cohesion or alignment, but instead splinter apart from each other. (As they arguably should, for they are likely the source of each other’s problems, whether they realize this or not.)

To address this underlying issue, the communities of the GPSE are divided into teams.

The teams of PyreSwap and the GPSE consist of “Covens” made of up actors known as “Witches,” and “Knighthoods” made up of actors known as “Knights.”

These teams also have designated captains, known as “Channelers” for Witches, and “Bannerets” for Knights.

Teams and Captains

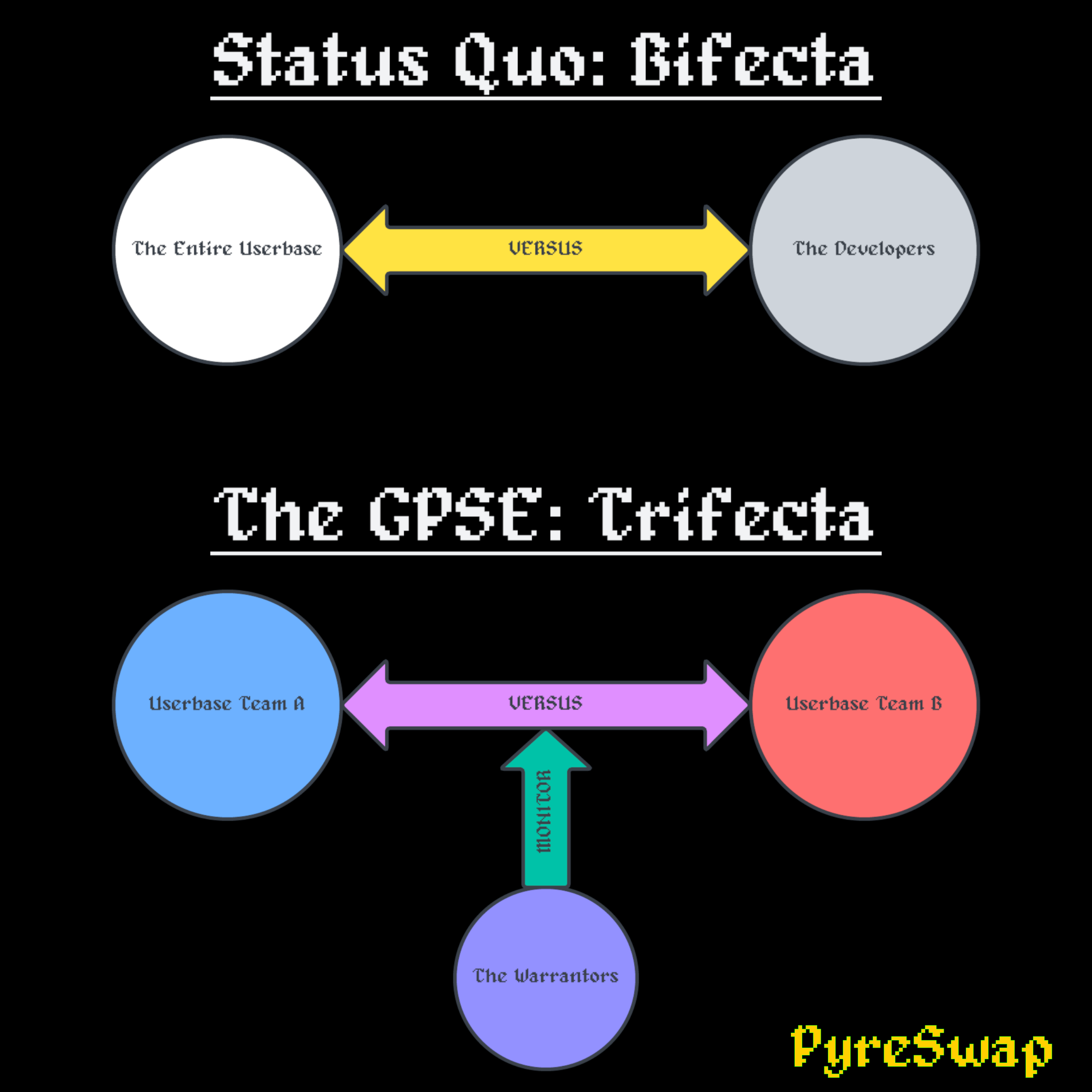

The GPSE has Teams, in order to diversify the roles and actors beyond the usual [dysfunctional] bifecta seen prevalently in web3.

Meaning that the userbase is organized into groups, that fundamentally have differences between them, and whose incentives do not directly align with each other.

This balances the environment, because the teams exist in explicit rivalry with each other.

This rivalry has benefit, both for the project and the users:

It provides for lasting community cohesion, since individual actors can now clearly identify who their antagonists are, if they are aligned with a specific team.

This evolves the community landscape from a bifecta into a trifecta.

The “developer” role, which would conventionally be recognized as being filled by the Seigniorage Circus organization, is there to simply act as referee and arbiter between the activities of the teams, and otherwise plays its own position(s) as that which is most “eco-neutral” or mutually beneficial to the other parties, or the environment as a whole.

So, to simplify:

The status quo, or "DeFi Conventionalism," attempts to build community via a bifecta of “the userbase” against “the developers,” while being completely ignorant of this dichotomy (and economic fulcrum), which therefore unknowingly exacerbates the tension point that ultimately leads to dissolution and failure.

The Greater PyreSwap Ecosystem builds community via a trifecta comprised of two(+) teams of actors explicitly competing with each other, while placing “the developers” into the role of referee or arbiter.

To be clear, the conduct of this competition is meant to be sportmanslike, and the intensity of the competition can wax and wane intermittently, based on certain context and/or events.

(The Seigniorage Circus does not consider it accurate to label themselves in the role of “the developers” in this context, rather it is more accurate to refer to the third role as “the warrantors.”)

The GPSE userbase has leaders, referred to broadly as "captains," (Bannerets for Knighthoods, and Channelers for Witch Covens) in order to clearly identify to the userbase who the leaders are.

These captains will be identified on the GPSE social media platforms, and are positions that can rotate among the userbase.

These captains are not personnel internal to the Seigniorage Circus Troupe, but rather designated leaders of the userbase.

Initial captains will be trained by Seigniorage Circus personnel, but there will be a fair degree of autonomy granted to them later, for the promotion and removal of other captains, as well as the methods used to organize and lead their userbase, in the future.

For a more detailed description of the Bannerets and the Channelers, as well as their training curriculum and teamwork strategies, please read The Long Version.

The userbase themselves, as individuals or otherwise, will have a variety of their own goals pertaining to the GPSE. It is the job of the captains to organize these users, for the purpose of maximizing the success rate of achieving these goals.

This, is part of the GPSE's GameFi.

It is not always going to be possible to please everyone! That is part of the GameFi, too.

It is not always going to be possible to trust your teammates! That is also part of the GameFi.

For a more detailed explanation on the knights and the witches, please read The Long Version.

The Incantation

Definitions of Incantation:

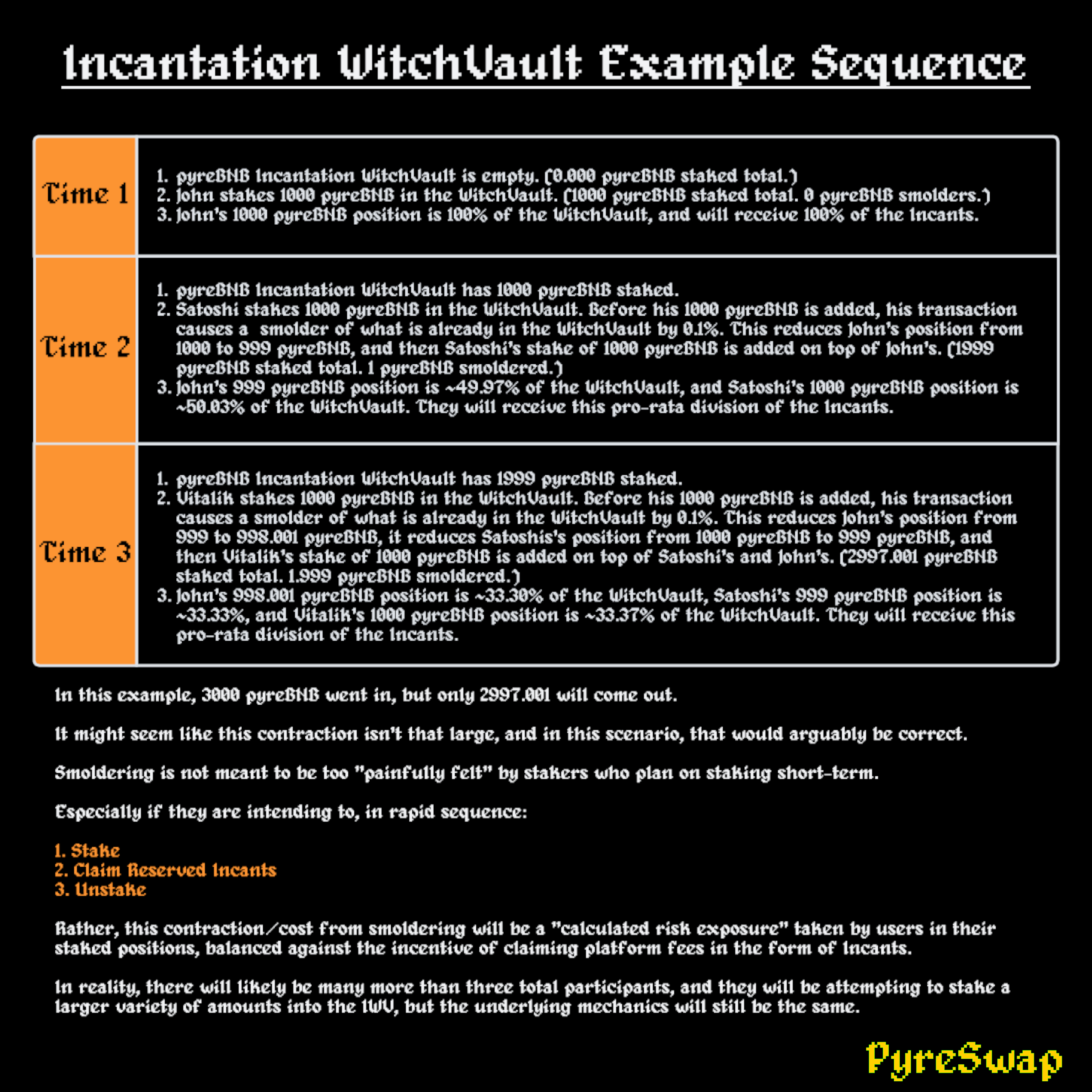

In the context of PyreSwap, the Incantation is the sequence of smart contract activities that accumulate swap fees from the DEX infrastructure, and recomposes the fees into a game event and distribution of yield reward, that is controlled by the epoch system.

The Incantation event is initiated on each new epoch's transpiration, which includes a portion of swap fees accumulated over an epoch's worth of time, to be consolidated into pyreBNB/pyreAVAX/pyreFTM, which is then queued for distribution to the Incantation WitchVault (IWV).

The rewards, as they become claimable from the Incantation WitchVault by users, are referred to as Incants.

Incants may be thought of as "shards" or "fragments" of the Incantation.

[This is not passive staking, so] Incants are not earned by IWV stakers, but rather reserved for them. If the user does not rapidly claim the Incants reserved for them, they may be claimed by other users, in a tactic known as "usurping."

Incants are divided (and reserved) pro-rata among the positions of the IWV stakers, via the epoch's transpiration, which is a blockchain transaction that can be initiated by anyone. If the epoch does not transpire, new Incants will not be made available to claim until it does.

The Incantation is also a component of the world and lore of the GPSE's GameFi.

For more information on the various ways to benefit from the Incantation, please read Strategy.

Smoldering

WitchVaults get their name because they burn at the stake. (Get it?) This type of burning is referred to as smoldering.

Definitions of Smolder:

In the context of WitchVaults, smoldering is in fact a 0.1% contraction of a user’s staked quantity, that is triggered by other users staking in after them. It burns the token quantity in tiny amounts, incrementally!

Sounds dangerous? It is!

Please keep in mind PyreSwap's NFB policy.

The above diagram is admittedly a simplification: In the current deployment configuration, each pyreBNB staking transaction receives stpyreBNB as a receipt token, which then becomes the container that actually experiences the smoldering contractions. However, including this detail does not seem to improve comprehension of the general idea.

Aside from the IWV, there are other WitchVaults that will be debuted later in PyreSwap's roadmap.

For more information on the mechanisms of the Incantation WitchVault, please read Strategy.

For more information on WitchVaults as a concept, please read The Long Version.

The Velvet Rope Pattern

The Velvet Rope Pattern (VRP) is a price action pattern of pyreAVAX/pyreBNB/pyreFTM, implied as a manifestation of the time-value of money, as it applies to the risk/reward profile of the Incantation's schedule.

It is resemblant of a repeating series of a volatility smile patterns, which are phenomena related to the price action of options, observed around the option price's perceived distance from crossing its moneyness threshold, either from one direction or the other.

The VRP is not always observed, nor does it always occur. However, each nonoccurrence [theoretically] increases the probability of a future reoccurrence.

It is a price chart waveform, named after the way a velvet rope barricade is supported by its stanchions.

It is an example of a component of vibratility.

For more information on the Velvet Rope Pattern, please read The Long Version.